Using Fresh Data to Navigate the Trends Surrounding COVID

Tuesday, April 28, 2020

By Michael Chung, director, market intelligence, Auto Care Association

Anyone who looks at weather forecasts knows that they are the best predictions based on available data. And while we know that forecasts are not always accurate, we use them to guide our activities. Now more than ever, the auto care industry yearns for accurate forecasts to guide our business operations and strategy for the coming months and quarters. Life as we know it has changed. Through it all, our work remains essential to moving the world forward.

As we watch current events unfold, we continue to ask, “When will this end? When will the economy recover? What will the future look like?” Our industry is continuously on the lookout for new data, accurate forecasts, and insights on upcoming market conditions. We have recently identified and introduced new data sources to the community – some of it is membership-based (e.g., TrendLens tracks 15+ years of Economic and Industry Indicator data; Demand Index charts point-of-sale data for a number of product categories and lines), while some are available to anyone (e.g., historic mileage statistics from the U.S. Department of Transportation).

Your associations are committed to sharing the most up-to-date and relevant data and resources that matter to you, our stakeholders. We are doubling down on providing insightful commentary and interpretation of the available data to promote dialogue within your own company as well as with the community. Our aim is to spark the conversations that allow you and your teams to make decisions informed by relevant data.

One of the biggest indicators for the auto care industry is vehicle miles traveled (VMT). We have seen this statistic decrease by nearly 50% since late February: as pictured on the right, INRIX reports that passenger travel was on average 48% lower during the week of April 4-10 than the week of February 22-29. Since then, average passenger travel has crept up a bit: as of April 24, it was 41% lower than the February 29 reference point.

In addition to sharing usage statistics like VMT, we are also committed to sharing original research to assure you that you’re not “going it alone” – sentiment regarding the impact COVID-19 spans the industry, based on collecting insights across the aftermarket.

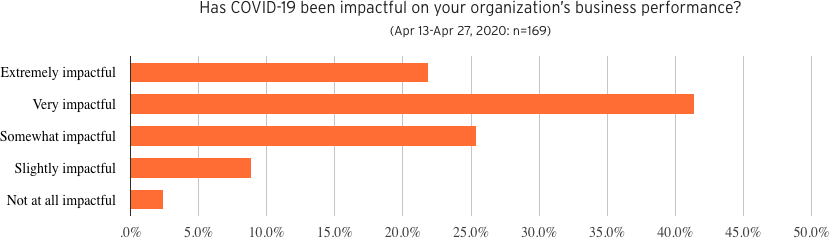

Based on responses to an Auto Care Association member survey collected from April 13 through April 27, we have found that COVID-19 is having a substantial impact on the business performance, investments, staffing, and demand for products and services for companies across the aftermarket, regardless of size or business type. Due to imminent concerns of financing day-to-day operations, aftermarket companies are aggressively managing their business operations to capture government assistance, shorten payment cycles, operate leaner, shorten work schedules, and reduce spending. While not hopeless, outlook for the future leans negative, and most expect the pandemic’s impact to last at least three months.

Nearly two-thirds (63%) of aftermarket organizations are experiencing a substantial impact on their business performance. Six out of seven aftermarket organizations (87%) reporting that COVID-19 has been at least “somewhat impactful” on business performance are seeing a decrease in demand for the services/products, with nearly half (46%) seeing a decrease of at least 26%.

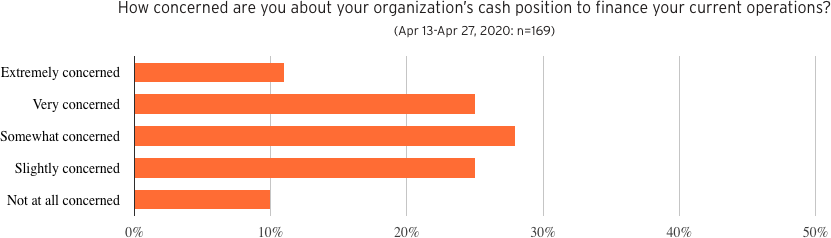

If you are a shop owner and are concerned about having enough cash, rest assured that you are not alone. Keeping operations running is a real concern for auto care companies of all types: one-third are “extremely concerned” (11%) or “very concerned” (25%) about their organization’s cash position to finance their current operations:

To address this, management is launching a holistic response, including:

- Staff adjustments, expense adjustments, applying for payroll protection program.

- Paying close attention to Accounts Receivable, having weekly meetings between sales and accounting. Working together to collect. Offering additional payment discounts for slower paying customers.

- Hiring Freeze; benefit cuts on 401(k) matching; dropping contracted services; eliminating all overtime; re-negotiating all contracted levels of service contracts; freezing bonuses and pay increases; cutting all non-essential expenses; selective terminations.

- Executive pay cuts, temporary layoffs, four-day work week.

- Apply for grants; applying for a loan; reducing hours; we have not yet laid anybody off, but that will be our next step.

- Applying for government loans.

- Not negotiating any extended terms for customers. Mandated each salary employee take five vacation days in the month of April. Defer payments to our suppliers 60-90 days.

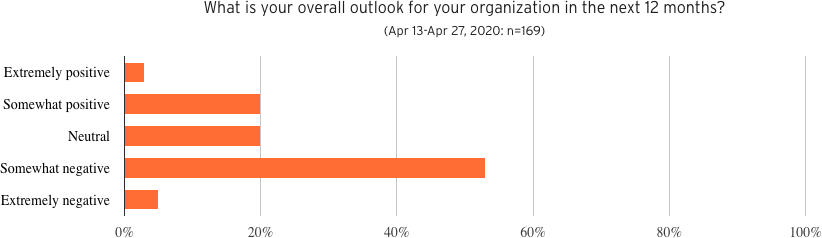

Not surprisingly, overall outlook for the next 12 months leans negative:

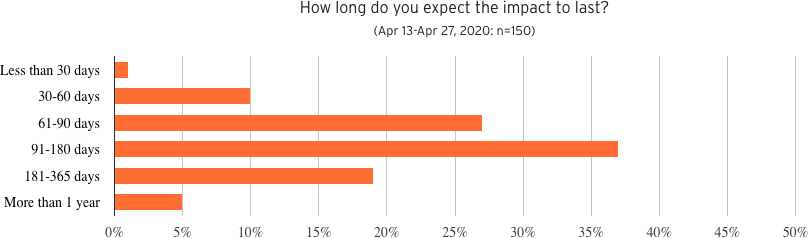

Three-fifths of aftermarket companies (61%) reporting that COVID-19 has been at least “somewhat impactful” on business performance expect the pandemic’s impact to last three months or longer. Note: Question asked of those responding “Somewhat,” “Very,” or “Extremely Impactful” to “Has COVID-19 been impactful on your organization’s business performance?”

As we look into a climate of business uncertainty, please be assured that we will continue to keep you up-to-date with the very latest in data and insights leading up to our homecoming at AAPEX. While the impact of current events continues to unfold, it’s important to note the historic resiliency of the aftermarket and together, we’ll move forward. Despite the crisis, we are still needed to keep vehicles on the world’s roads moving and AAPEX is here for us to reconnect and bring together the new tools and technology we need.

Mike Chung is director, market intelligence at Auto Care Association. With more than a dozen years of experience in market research, Chung and his team provide the industry with timely information on key factors and trends influencing the health of the automotive aftermarket and serving as a critical resource by helping businesses throughout the supply chain to make better business decisions. Chung has earned several degrees, including a Bachelor of Science in chemical engineering from Massachusetts Institute of Technology (MIT), a Master of Science in environmental health management from Harvard University and a Master of Business Administration with a concentration in marketing from Montclair State University.